Rev. Rul. 62-66, 1962-1 C.B. 83 A committee created by executive order of the governor of a state as an official agency thereof

Rev. Rul. 62-78, 1962-1 C.B. 86 Organizations exempt from Federal income tax under section 501 as described in section 501(c)(3)

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION CLAIM FOR REASSESSMENT REVERSAL FOR REGISTERED DOMESTIC PARTNERS

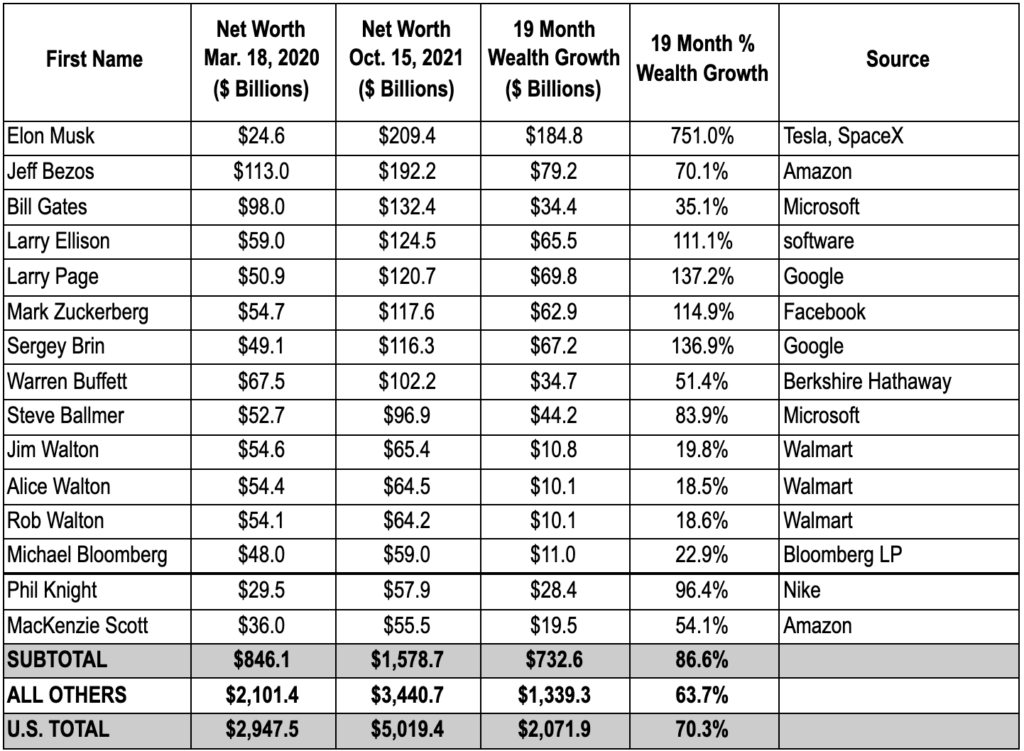

U.S. BILLIONAIRES WEALTH SURGED BY 70%, OR $2.1 TRILLION, DURING PANDEMIC; THEY ARE NOW WORTH A COMBINED $5 TRILLION - Americans For Tax Fairness

Bureau of Internal Revenue Philippines - Revenue Memorandum Circular No. 62-2016 Clarifies the proper tax treatment of passed-on Gross Receipts Tax. For full text, http://ow.ly/7FTX30216O5 | Facebook

BEFORE THE STATE BOARD OF EQUALIZATION OF THE STATE OF CALIFORNIA In the Matter of the Appeal of GEORGE F. AND MAGDALENA HERRMAN